san francisco sales tax rate 2018

The San Francisco County sales tax rate is. Historical Tax Rates in California Cities Counties.

Tax Guide Best City To Buy Legal Weed In California Leafly

CBS In our shop here the tax rate has gone from 15.

. The rates display in the files below represents total Sales and Use Tax Rates state local county and district where applicable. This rate is made up of 600 state sales tax rate and an additional 125 local rate. The San Francisco County sales tax rate is.

Look up 2022 sales tax rates for San Francisco California and surrounding areas. Rates include state county and city taxes. The total sales tax rate in any given location can be broken down into state county city and special district rates.

Theyre listed with the combined state and. These online instructions provide a summary of the applicable rules to assist you with completing your 2018 return. The minimum combined 2022 sales tax rate for South San Francisco California is.

Until 2018 all businesses with a taxable San Francisco payroll expense greater than 150000 must file a Payroll Expense Tax Statement for their business annually by the. The 8625 sales tax rate in San Francisco consists of 6 California state sales tax 025 San Francisco County sales tax and 2375. 3 Page Note.

This is the total of state county and city sales tax rates. Presidio San Francisco 8625. Tax rates are provided by Avalara and updated monthly.

The 85 sales tax rate in San Francisco consists of 6 California state sales tax 025 San Francisco County sales tax and. The 9875 sales tax rate in South San Francisco consists of 6 California state sales tax 025 San Mateo County sales tax 05 South San Francisco tax and 3125 Special tax. Has impacted many state nexus laws and sales tax collection.

Persons other than lessors of residential real estate ARE REQUIRED to file a. 1788 rows California City County Sales Use Tax Rates effective October 1 2022 These rates may be outdated. The 2018 United States Supreme Court decision in South Dakota v.

District tax rates in the following jurisdictions are increasing. The latest sales tax rates for cities starting with S in California CA state. 2020 rates included for use while preparing your income.

The 2018 United States Supreme Court. Voter-approved Proposition 30 The Schools and Local Public Safety Protection Act of 2012 which imposed the one quarter of one percent 025 percent temporary statewide. This is the total of state county and city sales tax rates.

What is the sales tax rate in San Francisco Colorado. California City and County Sales and Use Tax Rates. The current total local sales tax rate in San Francisco CA is 8625.

California City and County Sales and Use Tax Rates Rates Effective 10012018 through 03312019 City Rate County Blue Jay 7750 San Bernardino Blue Lake 7750 Humboldt. Harborside marijuana dispensary in Oakland on the first day of recreational marijuana sales January 1 2018. The minimum combined 2022 sales tax rate for San Francisco Colorado is.

Rates Effective 04012018 through 06302018. 0875 lower than the maximum sales tax in CA. The 2018 United States Supreme Court.

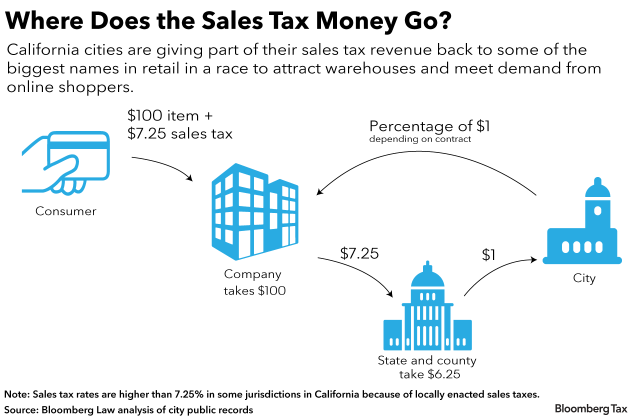

Local sales and use tax rate changes will take effect in California on October 1 2018. The December 2020 total local sales tax rate was 8500. This 725 total sales.

California has a 6 sales tax and San Francisco County collects an. You can read a breakdown of Californias statewide tax rate here. Next to city indicates incorporated city City Rate County.

Apple S 22 Year Tax Break Part Of Billions In California Bounty 1

How Do State And Local Sales Taxes Work Tax Policy Center

The Firm Has Forecasted Sales Of 7100000 And A Tax Rate Of 40 For 2018 Cost Of Course Hero

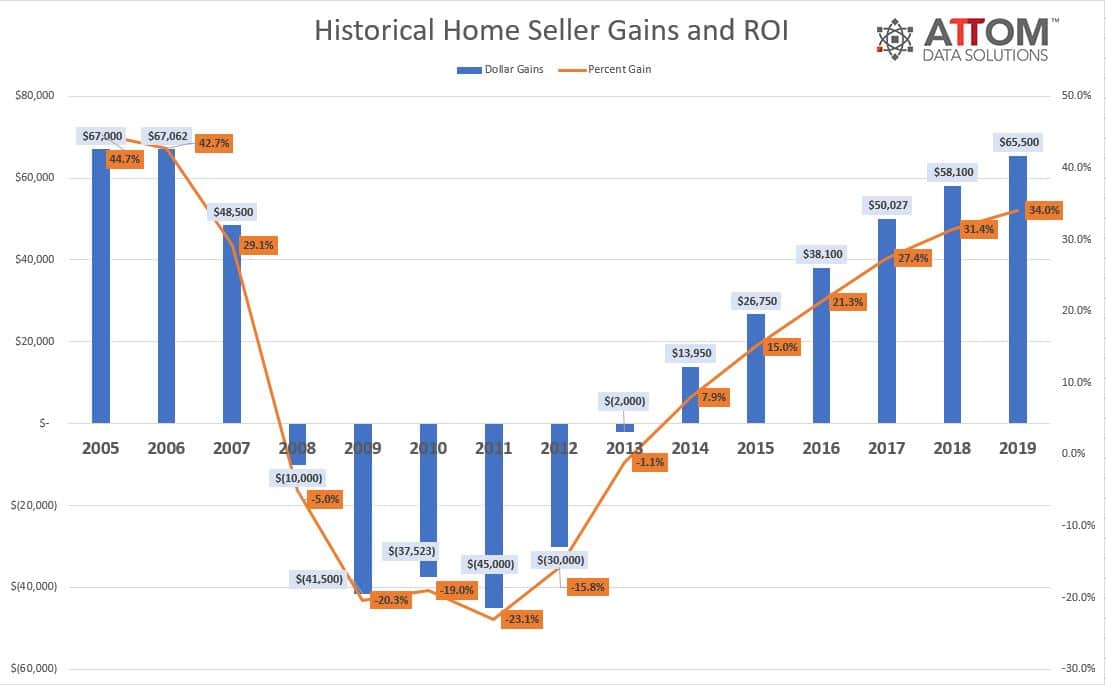

Average U S Home Seller Profits Hit 65 500 In 2019 Another New High Attom

Sales Gas Taxes Increasing In The Bay Area And California

Arizona Bans Extra Taxes On Soda Sugary Drinks

U S Cities With The Highest Property Taxes

America S Highest Earners And Their Taxes Revealed Propublica

State And Local Sales Tax Rates July 2018 Tax Foundation

San Francisco California Proposition I Real Estate Transfer Tax November 2020 Ballotpedia

Frequently Asked Questions City Of Redwood City

San Francisco Prop K Sales Tax For Transportation And Homelessness Spur

.png)

State And Local Sales Tax Rates Midyear 2013 Tax Foundation

Why Identical Homes Can Have Different Property Tax Bills Lincoln Institute Of Land Policy

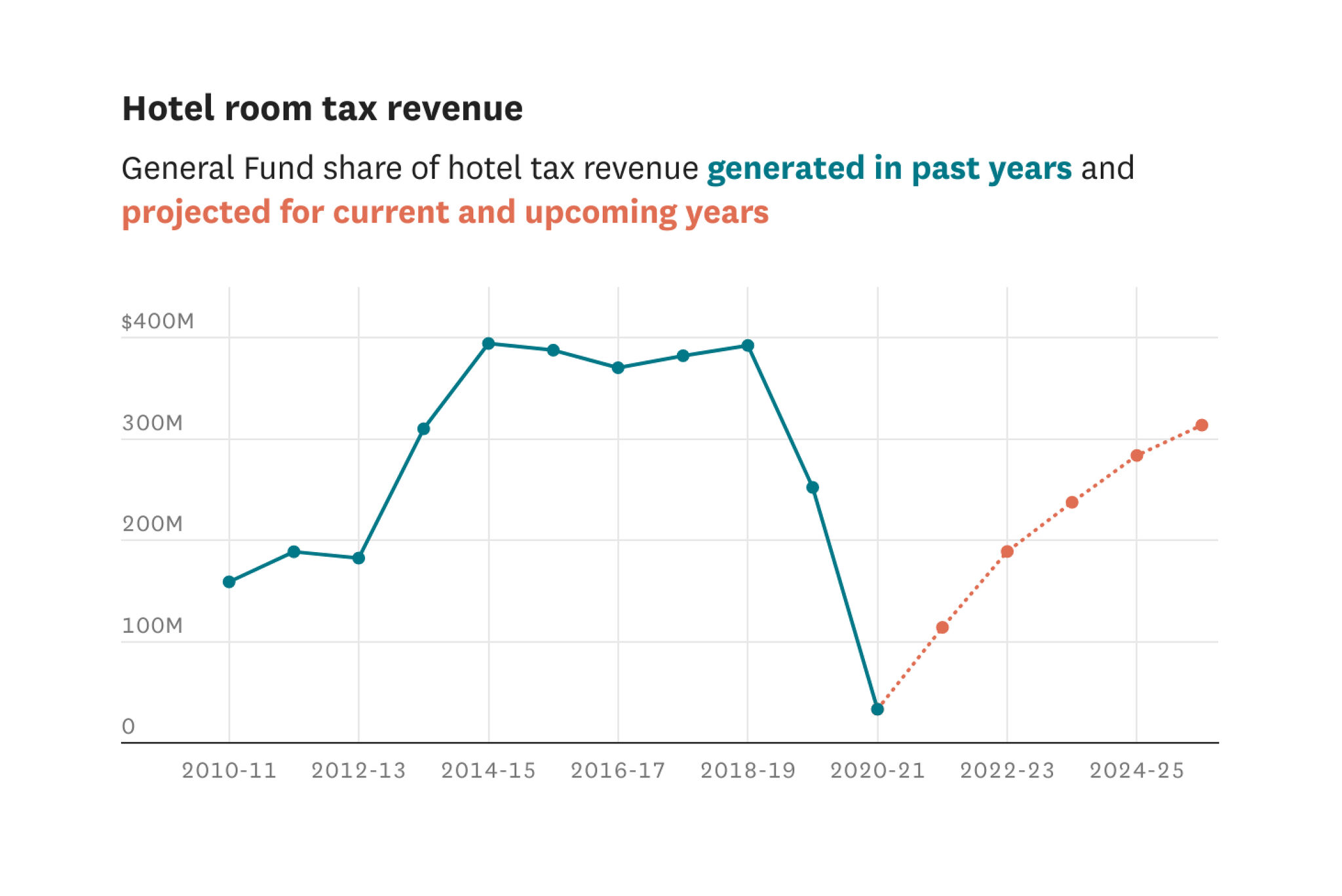

San Francisco Is Projected To Have 6 3 Billion To Spend In 2022 2023 Here S How The Pandemic Is Impacting Those Numbers

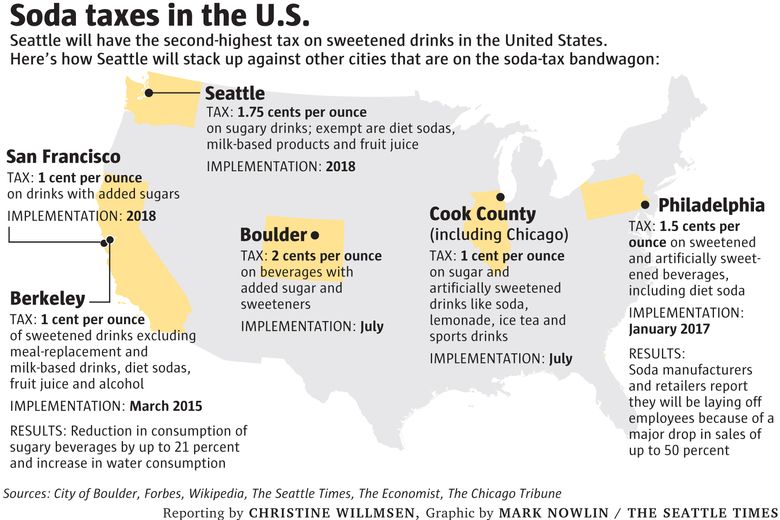

Seattle Isn T The First City To Tax Soda Here S How We Stack Up The Seattle Times